Origin and history of generic drugs

Generic drugs have been around for decades. However, their regulation was necessitated by several controversial occurrences within the market. In 1937, there was an incident associated with Elixir Sulfanilamide. It caused the death of approximately one hundred and seven people and eventually prompted the Federal Food, Drug and Cosmetic Act in 1938 in order to prevent such an accident again. That piece of legislation was responsible for instating rigorous testing for any new patented product in the market. However, this legislation made a big oversight; it did not cover identical products because these were not necessarily new drugs and it eventually compromised the quality of generic drugs entering the market at that time (Meyer, 1999). In 1951, the US started experiencing counterfeiting so the American pharmaceutical Association made resolutions. It was mandatory for pharmaceuticals to give out branded drugs for prescriptions or use generic drugs from specific manufacturers. The overall result was that generic drug manufacturers had fewer opportunities. 1962 saw the passing of the Kefauver Harris Amendment which required that all the drugs which had been created before the passage of that amendment go through efficacy evaluation as though they were new. This legislation has brought a lot of controversies because certain drug manufacturers have accused the FDA of corruption. They asserted that the FDA deliberately delayed their evaluation processes and therefore diminished their profitability. One such case was brought on by Mylan Laboratories and it was found that this group was justified in its claims concerning government officials’ corruption. On the other hand, it was also found that certain generic drug manufacturers were also corrupt in their own way because they were submitting false information to the respective authorities in order to speed up the time that their drugs took prior to approval. It should be noted that these accusations and counter-accusations went on for decades until the 1990s (Kirking et. al, 2001).

In 1965, the country passed a Medicaid amendment that was coupled with a social security act. These two legislations were responsible for increasing the market share of generic drugs in the American market. It was because Congress ordered a cost-effectiveness report on generic drugs. They concluded that welfare programs or other government-affiliated programs should continue to offer certain kinds of generic drugs so that patients can gain access to them; it really put generic drugs on the map.

In 1984, one of the most critical Acts was passed called the Hatch Waxman Act. The FDA no longer needed to approve generic drugs created by a drug manufacturer once it was possible to prove that a drug was identical in terms of its effects as well as its chemical components. Eventually, this eliminated the rigorous procedure that had been put in place before; it required those drugs to go through clinical trials. Subsequently, it allowed the public to access these drugs easily. Furthermore, it also gave leverage to generic drug manufacturers by allowing them to challenge a patent. If that generic manufacturer won the challenge then he or she would be able to get his drugs out to the market even before the patent of a brand name company had expired. In 1992, the Generic Drug Enforcement Act was passed that contributed towards the elimination of illegal acts by members of the generic drug industry (FDA, 2009). Scientific data was now given greater emphasis and severe penalties imposed on those who tried to break the rules by committing illegal acts. 1994 saw the creation of the Uruguay rounds agreement. It was responsible for increasing patent periods for drugs from 17 to 20 years. Generic manufacturers were therefore harmed by this. After these various legislations, landmark cases, amendments, policies and procedures, the generic drug industry could now be considered as a legitimate industry. Huge mergers have been taking place amongst generic drug manufacturers such that the US-based company Mylan acquired Merck KGA based in Europe in 2007. Another merger occurred between Teva and Barr. These companies have become highly profitable and responsible for large numbers of generic drugs in the international market. It now provides great savings advantages to the patients. As of 2008, it was estimated that about sixty percent of all the drugs bought within the United States are generic drugs. Not only are the advantages of generic drugs enjoyed by the consumer alone, studies show that retailers and other drug chain distributors are also enjoying greater profit margins owing to these drugs. It has been shown that manufacturers are also happy about these drugs because they need not invest too many resources in their manufacture as they do with branded drugs. Furthermore, medical practitioners have asserted that drug therapy adherence has increased because of the availability of the generic drugs easily and cheaply (Gatyas & Savage, 2008).

Production of generics and why generics are cheaper

There are several reasons why generics are cheaper. One of them lies in the fact that generic drug manufacturers never really start from scratch in the creation of a drug. They normally depend on the process of reverse engineering. Here, these companies will take a well-known and efficient or FDA-approved drug. They will then analyze its chemical constituents and work backward so as to discover the active ingredient and other components that gave the brand name drug its characteristics. After making that discovery, the generic drug manufacturer will then create a similar drug with the same degree of strength and dosage as the prototype. It will also possess the same effect and safety procedures that the original drug had. Even the manner of administering the generic drug should be the same as the brand name. This process of production implies that very little revenue will need to be spent in research and development and companies can therefore sell the drugs to consumers at reduced prices. It should be noted at this point that the process of doing research and development in the pharmaceutical industry is very costly. Some estimates indicate that it costs about 800 million US dollars to create a drug from scratch. The human clinical trials involved mostly account for these extremely high costs. On the other hand, some pharmaceutical drug manufacturers may use much less than that. Nonetheless, the conservative costs of total costs for making a brand-name drug are 100 million dollars and that is still a high price (Dimasi, 2003). Generic drug makers skip this part and are in a much better position to offer lower prices.

Another reason is that they are not patent-protected. Whenever drugs or any other products are patents protected, this often grants exclusivity to the company responsible for their creation and no other firm or competitor may come and produce that very product. This puts the brand name at an advantage because they can then raise the prices of their drugs without anyone really challenging them. In essence, a branded drug will always be in a position to enjoy the monopoly of the market within its patented period. This is especially common when the drug under consideration is new to the market. Conversely, generic drug manufacturers do not enjoy this privilege so another company may produce the drug and set it at a lower price. This eventually contributes to a high degree of competition and affordable prices. Several low-income patients have been able to buy the drugs very easily because of this fact (Shrank & Hoang, 2009).

As seen in the history of the generic drug industry, several legislations have been passed in order to regulate the quality and safety of drugs in the market. However, most of these regulations apply only to brand-name companies. Generic drugs are not recognized as new drugs so they need not go through all those rigorous procedures. The Abbreviated New Drug Application as passed in 1963 required all pioneer drugs to go through a process of safety and efficacy approval. This legislation still applies today and any brand-name drugs that have been investigated and found to be wanting in terms of an ineffective active ingredient are supposed to be removed from the market. This implies that pioneer companies have to wait for long periods of time before these procedures are completed. Also, the process of meeting those requirements costs a lot of money and eventually inflates the price of an original brand-name drug. All the clinical data must be submitted to the federal drug authority and this eventually affects prices. Although generic drugs also go through an approval process; they largely focus on bioequivalence rather than the efficacy or safety characteristics (FDA, 2010).

Advertising is also another source of loss of revenue for brand-name manufacturers. In this day and change, markets are flooded with so many media outlets so pharmaceutical companies have to dedicate a substantial portion of their revenue towards advertising and marketing efforts. They have to be more creative and more effective in disbursing their messages because there are so many options now. Eventually, this means that branding may inflate prices substantially. Generic manufacturers do not have to distribute free samples of their drugs or hire sales representatives because the drugs are already known by the public through the pioneer or brand name. Generic manufacturers also need not focus on showing the public the relevance of the product through presentations because the public is already aware of this.

Generally speaking, generic drugs are just low-cost drugs to produce; almost all their operating costs have been slashed when compared to pioneer drug manufacturers. This means that generic drug creators will always be in a position of selling them at a lower price without necessarily compromising on their own profitability.

Financial gains to retailers for selling generics

Retail pharmacies play a critical role in the supply of generic drugs within the population. They have been crucial in expanding the concept of competition for this drug. Normally, retailers have the choice of determining which interchangeable drugs they will stock in their shops. Most of them tend to choose either generic drugs or branded drugs because their stocking space is not unlimited. Because of this fact, a number of generic drug manufacturers have been selling their products through retailers.

Retailers themselves tend to focus on these generics because not only is their profitability going to be higher, but they also get more allowances through the generics. The table below illustrates what retailers stand to gain by selling generic drugs instead of focusing on branded ones. It should be noted that pharmaceutical retailers normally quote the prices of those generic drugs by combining a range of factors. First, there is the invoice price which they get either from distributors or companies themselves. Then they can add the allowable mark up to the invoice price. They are also required to charge a dispensing fee to consumers. This is normally the same price for both branded and generic drugs. However, allowable markups vary depending on the type of drug. All these additions are often made to the final drug. Usually, this comes in the form of a dispensing fee, the markup of the concerned drug as well as the dispensing fee is added to the invoice price in order to come to the retail price. Eventually, this leads to a much higher fee than initially quoted in the invoice (Generic Pharmaceutical Association, 2008). However, the amounts are usually lower for generic drugs when compared to branded ones. Here is a summary of what retailers stand to gain from the sale of this product.

As can be seen above, the return on investment for generic drugs is much higher than it is for branded products. This explains why a higher proportion of drugs in the current market are represented by this kind rather than the original pioneer brand (Davit, 2009).

Sales structure for generic high volume products like toothbrushes and tissue

In traditional high volume, branded products, it is usually quite easy to sell the product to a wide range of retailers because that brand is already well known and belongs to a large company. Retailers often prefer large companies because it means that they can be relied upon. Generic manufacturers may find it difficult to distribute their products using the traditional structure so they have to employ a new one.

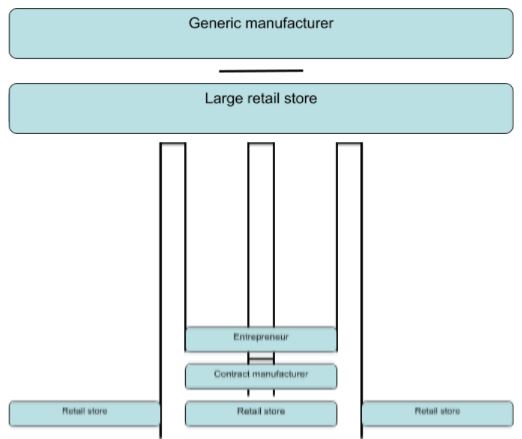

Some new generic high-volume entrepreneurs may not have the financial backing needed to secure a contract with a big-time retailer. In these circumstances, it may become necessary for them to use a contract manufacturer who already has the necessary experience and expertise in creating the product. Eventually, this can contribute towards better sales. The contract manufacturer will then put the seller of the generic product at an advantage because such a person can be able to secure deals with more than one retailer; this explains the second sales structure

On the other hand, if a businessman is responsible for the production of the commodities on his own, then such a person is likely to secure shelf space in only one retail store and this explains the first sales structure. Most of these generic products do not normally require the usual distribution channels as other conventional, branded high-volume products.

References

Gatyas, G.. Savage, C. (2008). IMS health reports on global generics sales growth. Web.

Shrank, W. & Hoang, T. (2009). Patients’ perceptions of generic medications. Health Affairs journal, 28(4), 546

FDA (2010). What are generic drugs? Web.

Kirking, D., Ascione, F. & Gaither, C. (2001). Historical overview of generic medication policy. Journal of American Pharmaceutical Association, 41, 567

FDA (2009). Milestones on US drug and food law history. Web.

Generic Pharmaceutical Association (2008). Authorized generics. Web.

Dimasi, J. (2003). Price of innovation: new estimates of drug development costs. Health economics journal, 22, 151

Meyer, G. (1999). History of regulatory issues of generic drugs. Transplant Procedures journal, 31, 10S

Davit, P. (2009). Comparing innovator and generic drugs. Annual Pharmacother, 43(10), 1583-1597