Market structure

According to the US government report of 2007, the market structure for both the prescription drugs (brand-name drugs) and generic drugs are changing significantly. It notes that for the last four decades there, is a small increase, in demand, for prescription drugs due to the increasing use of low, cost generic counterparts. At the same time, more drug safety warnings could have contributed to the declining usages among consumers.

In 2007, there was a mere growth of 4.9 percent, which was the lowest ever since 1963. Economists observe that there is a sharp decline in drug spending. However, they note that the slowdown in drug spending may only be temporary due to expirations of patents on commonly consumed and expensive brand-name drugs (Research and Markets, 2008).

The recession of 2007 affected the number of Americans with healthcare insurance. Consequently, the use of brand-name drugs also drops significantly. This report shows that the use of generic drugs accounted for 67 percent of all prescriptions in 2007, which is a difference increase of four percent considering the previous year. On the other hand, generic drugs cost between 30 to 80 percent less than brand-name drugs.

In general, the prices of drugs increased by 1.4 percent as compared to 3.5 percent in the year 2006. The number of safety warnings on the drugs grew to 68 from 21 in the year 2003. These warnings may have discouraged consumers from using such drugs. Also, they mainly affect commonly used drugs, such as those of diabetes, and anemia among others (Appleby, 2009).

Demand and Supply

According to O’Sullivan, Sheffrin and Perez demand is a “schedule that shows the various amounts of a product that consumers are willing and able to purchase at each of a series of possible prices during a specified period” (O’Sullivan, Sheffrin and Perez, 2011).

Demand also reflects the number of products that consumers will purchase at different possible prices given other factors do not change. The important factors of demand are that if other factors stay the same, as the price reduces, then the number of products demanded an increase. On the other side, an increase in price leads to a reduction in demand. This is what economists refer to as an “inverse or negative relationship between price and quantity of products demanded i.e. an inverse relationship called the law of demand” (O’Sullivan, Sheffrin, and Perez, 2011).

The context of “the other constant factors” is essential in this law. This is because apart from the price of the product, other factors affect the number of products purchased. For instance, the number of brand-name drugs bought will not only depend on the price of such brand-name drugs but also the prices of other alternative drugs (generic drugs) from the same manufacturer or a different one altogether.

Thus, the law of demand, in this scenario, dictates that consumers will purchase a small number of brand-name drugs if their prices increase and if the prices of generic drugs do not change i.e. remain constant. In other words, if the relative prices of brand-name drugs increase, then consumers will purchase a few brand-name drugs. However, if the prices increase affect all types of drugs, then consumers will purchase either a few or more of the brand-name drugs (Krugman and Wells, 2004).

We can look at the inverse relationship between the number of drugs demanded and prices from two perspectives. First, at any given period, each consumer of drugs, either generic or brand-name drugs, get reduced benefits in terms of effectiveness from each purchased unit of the drugs used. In this manner, the second purchase will even result in a greater reduced level of satisfaction than the previous purchase, and the trend will continue that way.

This means that drug usages depend on reducing marginal utility or benefit. Thus, the subsequent units of purchase yield even a greater reduced marginal benefit than the previous purchases. As a result, drug users will purchase more drugs than the previous purchases only if the prices of these drugs fall relatively. Second, we can also look at the law of demand about consumers’ income and the effects of substitution. The income effect shows that low cost improves the buying power of a consumer’s income. This allows the consumer to buy many products than he could have bought previously. Conversely, high prices give the opposite result.

The substitution effect hints that if we have a low price, then consumers have a reason to substitute a brand-name drug with that which is of low cost. For instance, consumers will substitute an expensive brand-name drug with a low-cost generic drug but for similar use. The low prices of generic drugs make them better purchases to consumers than brand-name drugs.

McConnell, Brue, and Barbiero write “supply is a curve or schedule that shows the amounts of a product that producers are willing and able to make available for sale at each of a series of possible prices during a specific period” (McConnell, Brue and Barbiero, 2002).

Supply also has relationships between prices and quantities. The law of supply states that an increase in prices increases the number of products supplied. On the other hand, a decrease in prices results in low supplies of products. A supply curve shows that companies will manufacture and supply large quantities of products for sale when prices are high than when they are low. Price hinders consumers from making purchases of many products. This implies high prices reduce the purchasing power of consumers. Conversely, the manufacturer or the supplier derives economic advantages from high prices. High prices motivate the manufacturer to produce and supply more products to the market.

For instance, drug manufacturers can change resources between alternative brand-name drugs and generic drugs. When the prices of generic drugs go up, the manufacturer will find it profitable to produce more generic drugs than brand-name drugs. The increased prices of generic drugs shall enable the manufacturer to cater to the growing costs resulting from the use of many inputs, machinery, and labor in the production of many generic drugs. The final results are more generic drugs in the market than brand-name drugs.

We must also acknowledge that, in manufacturing, several elements are present. Apart from the quantity in production, firms will also experience increased costs for every unit of product outputs. We must also note that firms have no adequate capacity to expand their firms quickly. In this case, the manufacturers rely on other resources for production. Some of these resources include labor for increased output.

However, the existing machinery experiences wear out, crowding, and congestion. This means that the output per worker will decrease, and prices will rise accordingly. In this case, a manufacturer can stop production unless he receives high prices from products. This implies that there is a direct relationship between the number of products supplied and prices (Gravelle, 2012).

Industry analysts have noted that the costs of generic drugs are increasing. As a result, competition comes to an end, and many suppliers reduce to just a few of them. Despite these rising costs, generic drug dealers acknowledge that generic drugs still provide huge profit margins and stability in retailing. On the other hand, brand-name drug profitability has dropped significantly. This has led to third party funding, cutbacks, and mergers and acquisitions.

Dealers in generic drugs report close gross margin among most consumed generic drugs in the year 2001. They observe that most generic drug manufacturers have abandoned low profitable drugs in pursuit of heavily consumed drugs in their industry. The twist is happening as these generic manufacturers are adopting marketing techniques that create brand names for them. Also, the costs of acquisitions have gone up as the number of generic drug manufacturers’ decrease. This implies that the costs of generic drugs to consumers have also risen accordingly.

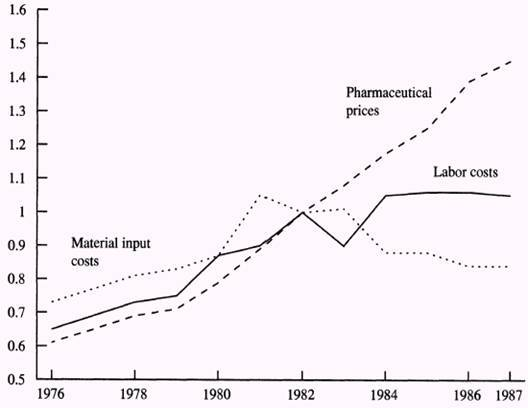

In 1982, Caves and other researchers found out that the manufacturers’ price indices in the pharmaceutical industry increased steadily just like the rise in costs of labor and material inputs. At first, they attributed increases in prices to increases in labor costs. However, they later noted that there were other factors such as inflation responsible for rising costs (Caves, Michael and Hurwitz, 1992).

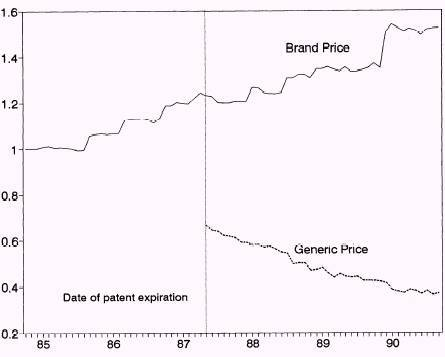

Further studies by Frank and Salkever established that most prices of brand-name drugs increased quickly in a market without generic equivalents. They argued that consumers who are sensitive to high prices abandoned brand-name drugs in favor of low-cost generic drugs. This assumption confirms the explanation we have given above regarding the prices of brand-name drugs and generic drugs (Frank and Salkever, 1992).

Grabowski and Vernon’s studies on the effects on prices of brand-name drugs due to the entry of generic drugs concluded that generic drugs were major sources of competition to brand-name drugs. They led to declining prices of brand-name drugs significantly. At the same time, as the number of generic entrants also increased, the prices of other generic drugs took downward trends steadily.

Patent

Guellec and Potterie define patent as “the exclusive right of an inventor to use, or to allow another to use, her or his invention” (Guellec and Potterie, 2007). They note that “patents and patent laws aim to protect the owner from rivals who would use the invention without having shared in the effort and expense of developing it” (Guellec and Potterie, 2007). Patents also provide the owner with a monopoly up to the expiry of the patent. Countries of the world have agreed on a “uniform patent life of 17 years from the time application” (FDA, 2006). Most multinational corporations have gained their status due to protection according to their patents.

Just like in other industries, patents on brand-name drugs are responsible for the creations of monopoly and subsequent profits that have helped fund other research for patentable drugs. Thus, the patent creates monopoly power that can result in a self-sustaining company. However, patents expire and create room for competition from generic drugs.

In the US, brand-name drugs have their approvals from the US Food and Drug Administration (FDA). The US FDA also approves “generic drugs on the ground that they are safe and effective just like their brand-name counterparts” (FDA, 2006).

Manufacturers of generic drugs are aware that they cannot sell their generic drugs until the patent of the brand-name drugs expires. For instance, Barr Laboratories could not sell the generic fluoxetine until the patent had expired on the brand-name equivalent, Prozac (Olfson and Pincus, 2006). Brand-name drug manufacturers must apply for a patent to protect their inventions from duplication and subsequent competition and profit loss. During the patent lifetime, the only original manufacturer of the drug can sell, improve, or modify it through research. It is only after the expiry of the patent that a generic drug manufacturer can apply for approval from the US FDA to sell his generic version of the brand-name drug.

The costs of generic drugs are low, and they are responsible for stiff market competition in the drug industry. FDA requires that all generic drugs must meet their specifications concerning “safety, effectiveness, bioequivalence, manufacturing and labeling” (FDA, 2006). The law also requires that all generic drugs have similar active ingredients as brand-name (FDA, 2006).

The distinction between generic and brand-name drugs

All drugs contain active ingredients in them. Apart from these active ingredients, there are certain drugs with other ingredients, which are not active because they do not work to fight body infections. However, inactive ingredients have their purposes too. These inactive ingredients may work in balancing pH level, improving taste, or enhancing appearances among other functions. However, they have no effects when used in the human body.

As we have noted above, brand-name drugs and generic drugs contain the same active ingredients, but their prices differ considerably. Brand-name drugs are “more expensive than their generic equivalent” (Frederick, 2001). We can use economics to explain this difference in prices (Frederick, 2001).

Brand-name drugs usually have a market monopoly until their patents expire. This normally occurs after more than a decade of making money to the inventors. Brand-name drug manufacturers usually invest a lot of resources in terms of money, research, trials, reviews, and time in developing their drugs.

Consequently, the FDA has to conduct its review on the drug. It must determine whether the drug meets all the safety and effectiveness before it can approve it for markets and consumers.

The FDA must determine how effective and safe the drug is concerning its study results. This is also a cost to the brand-name drug manufacturer to have his documents reviewed. During this process, the manufacturer can only hope that he will recover his investment and get profit afterward. Legally, the manufacturer must get a patent to protect his drug from imitation and competition. Patents usually “expire after 17 years” (FDA, 2006).

After the expiry of the patent, generic manufactures are free to produce their version of the drug without conducting more research and studies. These generic drug manufacturers do not engage in any trials, huge investment, and or elaborate procedures. From an economic point of view, this explains why generic drugs cost less as compared to brand-name drugs.

References

Appleby, J. (2009). Spending on prescription drugs slows. US Today, 2(1), 3-4.

Caves, R., Michael, W., and Hurwitz, M. (1992). Patent Expiration, Entry and Competition in the U.S. Pharmaceutical Industry: An Exploratory Analysis. Microeconomics, 1991(1991), 1-48.

FDA. (2006). Greater Access to Generic Drugs: New FDA Initiatives to Improve the Drug Review Process and Reduce Legal Loopholes. Consumer Magazine, 4(8), 2-6.

Frank, R. and Salkever, D. (1992). Pricing, Patent Loss and the Market for Pharmaceuticals. Southern Economic Journal, 59(12), 165-179.

Frederick, J. (2001). Generics still a profit stream as pharmacy margins trickle. Drug Store News, 1(12), 1-2.

Gravelle, H. (2012). Microeconomics, (4th ed.). New York: Prenticehall.

Guellec, D. and Potterie, B. (2007). The Economics of the European Patent System: IP Policy for Innovation and Competition. Oxford: Oxford University Press.

Krugman, P. and Wells, R. (2004). Microeconomics. New York: Worth Publishers.

McConnell, C., Brue, S. and Barbiero, T. (2002). Microeconomics: Canadian Edition (9th ed.). Toronto: McGraw-Hill/Ryerson.

Olfson, M. and Pincus, A. (2006). Listening To Generic Prozac: Winners, Losers, and Sideliners. Health Aff, 25(3), 707-719.

O’Sullivan, A., Sheffrin, S. and Perez, S. (2011). Microeconomics, Principles Applications, and Tools, (7th ed.). New Jersey: Prentice Hall.

Research and Markets. (2008). Booming US Generic Drug Market. Business Wire, 1(2), 1-90.